Beginner's Guide

Are you curious about how to start share trading but don’t know where to begin? You’re not alone. Share trading may sound complicated with its financial terms and technical jargon, but with the right guidance, even beginners can start their journey with confidence. This detailed blog will explain the basics of share trading, the different formats (offline and online), the exact steps to begin online trading, the popular share trading platforms in India, a checklist you can follow, FAQs for beginners, and a simple glossary of common trading terms. By the end, you will have a clear roadmap to how to start share trading and enter the exciting world of trading.

What Is Share Trading?

Share trading simply means buying and selling shares (or stocks) of companies listed on stock exchanges like NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). When you buy a share, you become a part-owner of that company. If the company grows, its share price usually increases, giving you profits. Similarly, you can also lose money if prices fall. Trading also extends to other financial products like bonds, derivatives, and exchange-traded funds (ETFs).

Formats of Share Trading in India

1. Offline Trading

Before the rise of online platforms, most trading in India was done offline through traditional brokers. Even today, some investors—especially those less comfortable with technology—still use this method.

How It Works

Placing Orders – In offline trading, you cannot directly access the stock exchange. Instead, you place buy or sell orders by either:

Visiting your broker’s office in person.

Calling your broker over the phone and instructing them.

Broker’s Role – The broker then manually executes these trades on your behalf through their terminal connected to the stock exchange. You receive a trade confirmation slip or contract note later.

Payments & Settlements – You must ensure your broker has the required funds (for buying shares) or the shares themselves (for selling). This is usually handled through cheques, demand drafts, or linked bank accounts.

Pros of Offline Trading

Personal interaction with an experienced broker who can guide you.

Useful for those who are not tech-savvy.

Helps investors who prefer face-to-face trust-based dealings.

Cons of Offline Trading

Slower execution compared to online trading.

Higher brokerage charges since brokers spend manual time.

Limited convenience—you cannot trade instantly on your own.

Risk of miscommunication over calls or paperwork delays.

2. Online Trading

Online trading has revolutionized the way people invest in the stock market. Unlike offline trading, it allows you to buy and sell shares directly from your computer, tablet, or smartphone using a broker’s app or website.

How It Works

Direct Access – Once you open a trading and Demat account with a broker, you can log in to their online platform anytime. You can place buy or sell orders instantly without waiting for a broker to execute them.

Live Market Data – Online platforms provide real-time stock prices, charts, and news. This allows you to make informed decisions based on the latest market trends.

Research Tools – Many brokers offer tools like technical analysis charts, stock screeners, historical performance data, and expert recommendations, helping you analyze potential investments.

Advantages of Online Trading

Faster Execution – Orders are executed in seconds, unlike offline trading which may take hours or days.

Lower Costs – Brokerage charges are significantly lower since there’s no manual intervention.

Transparency – You can track your transactions in real-time and view your holdings immediately.

Convenience – Trade from anywhere, 24/7, using your laptop or mobile device.

Why It’s Better for Beginners

Online trading gives beginners control, flexibility, and learning opportunities. You can start with small amounts, experiment safely, and gradually gain confidence in managing your own portfolio.

3. Institutional/Advanced Trading Formats

While most retail investors use online or offline trading, there are more sophisticated methods used primarily by institutional investors, professional traders, and high-volume market participants. These advanced formats allow faster, automated, and large-scale transactions.

1. CTCL (Computer To Computer Link)

What it is: A system where brokers’ computers are directly connected to the stock exchange servers.

Purpose: Enables faster execution of high-volume trades without manual intervention.

Who uses it: Mostly used by professional brokers and large institutional traders.

2. IBT (Internet Based Trading)

What it is: Trading through secure internet platforms provided by brokers.

Purpose: Allows both retail and professional investors to access the market online.

Difference from regular online trading: IBT platforms often provide more advanced tools, analytics, and faster execution for large-volume trades.

3. DMA (Direct Market Access)

What it is: Investors or institutions can place orders directly on the exchange using their own trading systems, bypassing brokers’ manual intervention.

Purpose: Speeds up the process and gives more control over order execution.

Who uses it: Institutional investors, hedge funds, and algorithmic traders.

4. Algorithmic Trading

What it is: Automated trading using computer algorithms that follow pre-defined rules to buy and sell stocks.

Purpose: Executes trades faster than humans, capitalizes on price differences, and manages risk efficiently.

Who uses it: High-frequency traders, institutional investors, and quantitative traders.

Key Takeaway for Beginners

While these advanced formats are powerful, they require technical knowledge, high-speed systems, and significant capital. Beginners should start with standard online trading platforms and gradually learn the market before exploring these advanced methods.

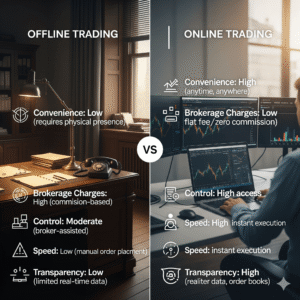

Offline vs Online Trading: Which Is Better?

For beginners, online trading is the best choice because it gives flexibility, lower charges, and better control.

What You Need Before You Start

Accounts Needed to Start Trading

Before you can begin trading in the stock market, you must set up a couple of essential accounts and keep certain documents ready.

1. Demat Account

A Demat (Dematerialized) Account is like a digital locker that stores all your shares in electronic form. Without this, you cannot hold stocks as physical share certificates are no longer issued. For example, if you buy 50 shares of Infosys, they will be credited and stored safely in your Demat account.

2. Trading Account

A Trading Account acts as the gateway to the stock exchange (NSE or BSE). It allows you to place buy or sell orders. While the Demat account stores your shares, the trading account executes your transactions. Usually, brokers open both accounts together to make the process seamless.

3. Bank Account

Your bank account is linked to the trading account for transferring funds in and out. When you buy shares, money is debited from your bank account. When you sell shares, the sale amount is credited back.

Documents You Need for Account Opening

To comply with regulations and ensure security, you’ll need the following documents:

PAN Card – Mandatory for all financial transactions in India.

Aadhaar Card – Used for KYC (Know Your Customer) verification, often linked with mobile number for OTP-based e-KYC.

Bank Account Proof – A canceled cheque or bank statement to link your account.

Passport-size Photos – For verification and profile purposes.

Once these are submitted online (via e-KYC) or offline (through a broker), your account is verified and activated, usually within 24–48 hours.

Step-by-Step Guide to Online Share Trading

| Step | Activity |

|---|---|

| 1 | Choose a Broker/Platform – Select a trusted broker (see list below). |

| 2 | Open Demat and Trading Accounts – Apply online through the broker’s website/app. |

| 3 | Complete KYC – Upload documents (PAN, Aadhaar, proof of address, photo). |

| 4 | Verification – E-KYC or in-person verification is done by the broker. |

| 5 | Link Your Bank Account – Required for fund transfers. |

| 6 | Activate Platform – Log in using the broker’s app or website. |

| 7 | Add Funds – Transfer money into your trading account. |

| 8 | Research Stocks – Study companies before buying. |

| 9 | Place Your First Trade – Start with a small amount to gain experience. |

| 10 | Track Portfolio – Monitor profits, losses, and overall performance. |

| 11 | Stay Secure – Enable 2FA and avoid scams. |

5 Popular Share Trading Platforms in India

1. Zerodha – https://zerodha.com/

India’s largest discount broker.

Known for its Kite trading platform and Varsity (educational resources).

Low brokerage and easy interface.

2. Groww – https://groww.in/

Beginner-friendly app.

Offers stocks, mutual funds, ETFs, IPOs, and more.

Simple and clean interface.

3. Upstox – https://upstox.com/

Backed by Ratan Tata.

Provides advanced charting tools.

Competitive brokerage charges.

4. Angel One – https://www.angelone.in/

Full-service broker.

Offers research reports and advisory services.

Good for both beginners and experienced traders.

5. 5paisa – https://www.5paisa.com/

Affordable brokerage plans.

Offers auto-investing and portfolio management tools.

Great option for long-term investors.

Checklist to Start Online Share Trading

| Step | Activity |

|---|---|

| 1 | Choose a Broker/Platform – Select a trusted broker (see list below). |

| 2 | Open Demat and Trading Accounts – Apply online through the broker’s website/app. |

| 3 | Complete KYC – Upload documents (PAN, Aadhaar, proof of address, photo). |

| 4 | Verification – E-KYC or in-person verification is done by the broker. |

| 5 | Link Your Bank Account – Required for fund transfers. |

| 6 | Activate Platform – Log in using the broker’s app or website. |

| 7 | Add Funds – Transfer money into your trading account. |

| 8 | Research Stocks – Study companies before buying. |

| 9 | Place Your First Trade – Start with a small amount to gain experience. |

| 10 | Track Portfolio – Monitor profits, losses, and overall performance. |

| 11 | Stay Secure – Enable 2FA and avoid scams. |

Common Mistakes Beginners Should Avoid

1. Investing Without Research

Many beginners jump into the stock market by buying shares based on hype, rumors, or news without studying the company’s financials, performance, and future potential. This can lead to heavy losses. Always analyze the business, industry trends, and risks before investing.

2. Putting All Money Into One Stock

Relying on a single stock is risky because if that company underperforms, your entire investment suffers. Diversification across multiple sectors and companies reduces risk and balances returns.

3. Trading With Borrowed Funds

Some new traders borrow money or use margin trading to make quick profits. While it may amplify gains, it can also magnify losses, leaving you in debt. It’s safer to trade only with surplus funds you can afford to lose.

4. Ignoring Transaction Charges and Taxes

Every trade involves brokerage charges, STT (Securities Transaction Tax), GST, stamp duty, and other fees. Ignoring these costs can reduce profits significantly. Similarly, capital gains tax applies to stock trading, so keep tax planning in mind.

5. Falling for Stock Market Tips From Unreliable Sources

Blindly following “hot tips” from social media, friends, or unverified websites often leads to losses. Genuine stock research takes time and expertise. Trust only SEBI-registered advisors or do your own thorough analysis.

Safety Tips for Online Trading

1. Always Use Strong Passwords and Two-Factor Authentication

Weak or simple passwords make your trading account vulnerable to hacking. Use a combination of uppercase, lowercase, numbers, and special characters. Enabling two-factor authentication (2FA) adds an extra security layer by requiring a one-time code (OTP or authenticator app) along with your password.

2. Avoid Using Public Wi-Fi for Trading

Public Wi-Fi networks in cafés, airports, or hotels are often insecure and can expose your login details to hackers. Always use a private, secure internet connection or a trusted mobile network when accessing your trading account.

3. Check If the Broker Is SEBI-Registered

Before opening an account, verify that the broker is registered with SEBI (Securities and Exchange Board of India). This ensures that the platform operates legally and follows strict regulations to protect investors. You can confirm registration on SEBI’s official website.

4. Don’t Share Account Credentials With Anyone

Never share your trading account ID, password, or OTP with friends, relatives, or so-called “market experts.” Scammers often trick beginners into giving away login details, leading to unauthorized trades or fund theft. Keep your credentials strictly private.

FAQs on Share Trading for Beginners

Q1. What is the minimum amount needed to start share trading?

You can start with as little as ₹100–₹500. There’s no fixed minimum, but having ₹1,000–₹5,000 is a good start.

Q2. Is trading safe for beginners?

Yes, if you use SEBI-registered brokers and avoid risky practices like speculative trading in derivatives.

Q3. Do I need to pay taxes on profits?

Yes, profits from shares are taxable under capital gains. Keep track of all transactions.

Q4. What is the difference between trading and investing?

Trading means short-term buying and selling for quick profits, while investing is holding shares for years to benefit from company growth.

Q5. Can I lose all my money in trading?

If you invest in a single risky stock without research, it’s possible. Diversification and proper planning reduce this risk.

Glossary of Common Trading Terms

Demat Account: Digital account to store shares.

Trading Account: Account to place buy/sell orders.

Brokerage: Fee charged by the broker for executing trades.

Equity: Shares of a company.

IPO (Initial Public Offering): When a company offers shares to the public for the first time.

Dividend: Profit shared by a company with its shareholders.

Bull Market: When share prices are rising.

Bear Market: When share prices are falling.

Stop Loss: An automatic order to sell a share when it reaches a certain price to prevent big losses.

SEBI: Securities and Exchange Board of India, the regulator of markets.

Finally

How to start share trading has always been a big question for the beginners. However share trading in India is no longer limited to professionals—it’s accessible to everyone thanks to online platforms. By understanding the basics, opening a Demat and trading account, and using a trusted broker, you can begin your trading journey safely. Remember to start small, do your research, and always keep security in mind. With the right knowledge and tools, you can confidently enter the stock market and grow your wealth.

This post is shared to inspire curiosity and deepen understanding.

Comments are closed.