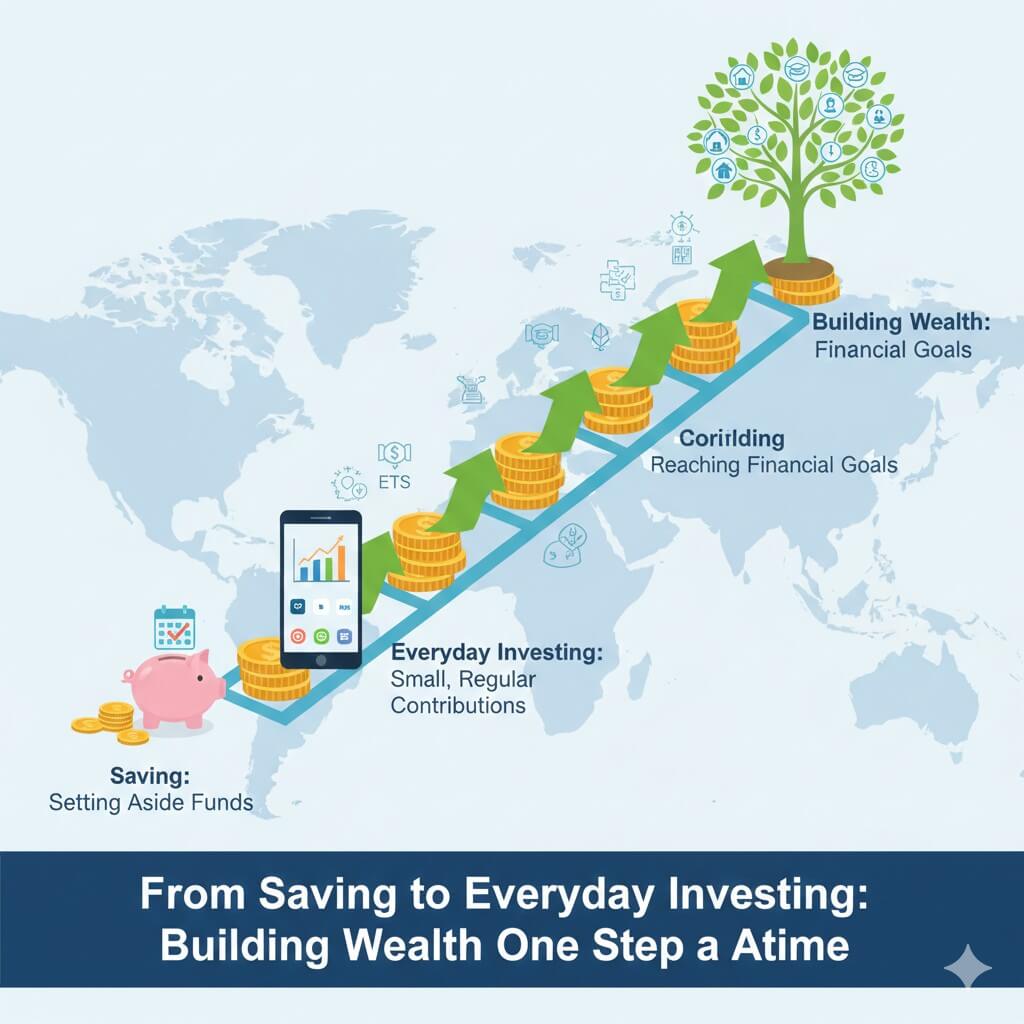

From Saving to Everyday Investing: Building Wealth One Step at a Time

Think back to when your grandparents taught you to drop coins into a piggy bank, or when you opened your first fixed deposit and felt the comfort of guaranteed returns. For generations, saving has been the ultimate financial wisdom—safe, predictable, and simple.

But times have changed. Today, young professionals casually chat about mutual funds over coffee, students explore investment apps on their phones, and investing has moved from being an elite pursuit to an everyday habit. The real question isn’t “Should I invest?” anymore—it’s “Why saving alone is not enough to secure my future?”

This article takes you through the journey: from traditional saving habits to the world of everyday investing, where small, consistent steps can grow into lasting wealth.

The Role of Saving: Still Important, But Limited

Saving has always been the backbone of financial stability. It teaches discipline, provides a cushion against emergencies, and helps with short-term goals. Instruments like savings accounts, fixed deposits, and recurring deposits have served millions well.

But here’s the catch: it is inflation. With prices rising every year, the 2.5 – 4% interest from a savings account means your money is actually losing value. Even a fixed deposit at an interest rate of 6% barely keeps up once you consider inflation and taxes.

Savings are essential for liquidity and security, but they can’t build wealth or fund long-term goals like retirement or children’s education. Think of savings as the foundation of your financial house—you still need walls and a roof, and that’s where investing comes in.

Why Everyday Investing Matters

The reality is quite simple: saving alone won’t keep pace with rising costs. What costs ₹100 today could cost ₹200 in ten years. Add in healthcare, education, and lifestyle expenses, and you’ll see why investing is no longer optional but a conscious choice for financial stability.

Everyday investing means putting small amounts into investment channels regularly, and that too regardless of market ups and downs. Thanks to technology, now it’s easier than ever. Systematic Investment Plans (SIPs) let you start with as little as ₹500 a month, while micro-investing apps allow you to invest even spare change.

The benefits are powerful and significant:

Compounding: Small, regular investments can grow into a lot over time.

Accessibility: Investing is easy and open to everyone.

Freedom: Everyday investing helps you become financially independent and make choices without money stress.

For example, a ₹5,000 monthly SIP at 12% annual returns can grow to over ₹46 lakh in 20 years, and almost ₹1.5 crore in 30 years. That’s the magic of compounding. One can check it in the SIP calculators available online.

Tools & Platforms for Everyday Investors

Digital platforms have transformed investing. You can now open an account in minutes and manage everything from your phone.

- SIPs: They are the backbone of disciplined investing. By investing a fixed amount monthly, you you don’t get caught up in the market volatility.

- Fractional Shares: Here, one can invest in leading companies without needing huge sums of money.

- ETFs (Exchange-Traded Funds): These are a mix of stocks or bonds packaged together, giving you diversification in one investment.

- Robo-Advisors: AI-driven platforms that suggest portfolios based on your goals and risk appetite, taking the guesswork out of investing.

- Alternative Options: Gold ETFs, REITs (real estate trusts), and even cryptocurrencies (with caution) are the other equally important avenues of investing.

So, what is the common thread? Low minimum investments, mobile-first platforms, and user-friendly interfaces. Thus, investing has become as simple as ordering food online.

Balancing Saving & Investing

Investing is powerful, but savings are still crucial. The trick is to balance both of them. You can try the following:

- Step 1: Build an emergency fund (3–6 months of expenses) in liquid savings.

- Step 2: Once that’s secure, channel surplus income into investments.

- Step 3: Use frameworks like the 50-30-20 rule (50% needs, 30% wants, 20% savings/investments). U.S. Senator Elizabeth Warren and her daughter, Amelia Warren Tyagipopularized the 50/30/20 budget rule in her book, “All Your Worth: The Ultimate Lifetime Money Plan.”

This isn’t rigid— you can adjust it based on your life stage. Young professionals might invest 30–40%, of their income while families may start with only 10–15%. The principle is simple : savings protect you today, investments grow your tomorrow.

Everyday Habits That Build an Investor Mindset

Investing isn’t just about money—it’s about habits that help you grow steadily and stay financially prepared.

- Automate contributions: You can set up auto-debits so your investments happen automatically every month, helping you stay consistent. This would also help in ensuring that you never miss a contribution.

- Track expenses: Redirect unused subscriptions or small luxuries into investments, for example by moving the money from a cancelled OTT subscription directly into a monthly SIP.

- Learn the basics: It is very important to get a clear understanding of risk, diversification, and asset allocation. This knowledge helps you make informed decisions and avoid common investing mistakes.

- Celebrate milestones: That first ₹10,000 in your portfolio or first dividend payout builds confidence.

- Stay consistent: One should remember that it is not about timing the market— it’s about time in the market. Even small, regular investments can compound meaningfully when maintained over years..

Risks & How to Stay Safe

Investing comes with risks, but they’re manageable if you stay disciplined. By spreading your money across different investment channels and investing regularly, you can handle market ups and downs more easily.

Volatility is normal: Markets rise and fall; don’t panic.

Avoid herd mentality: Don’t chase trends just because others do—this is a trap.

Diversify: Spread investments across different assets to reduce risk. This is one of the wisest decisions you can make.

Think long-term: Equity investments need 5–7 years to deliver results. Panicking and withdrawing your money early may hinder growth.

Control emotions: Fear and greed are the biggest threats to investors. Patience and discipline consistently outperform emotional reactions.

Conclusion: Your Money Should Work As Hard As You Do

Moving from saving to everyday investing is more than a financial shift — it’s a mindset change. Saving teaches discipline, while investing brings greater financial security and builds freedom.

You don’t need to be a wealthy person to start investing. Whether it’s ₹500 or ₹5,000 a month, the key is consistency. Time is your greatest ally, and compounding does the heavy lifting.

Start where you are and with what you have. First build your emergency fund, then invest regularly. Automate, diversify, and review annually. Let your money grow quietly while you focus on your career and passions. Ultimately, it’s not about whether you can afford to invest, but whether you can afford not to.